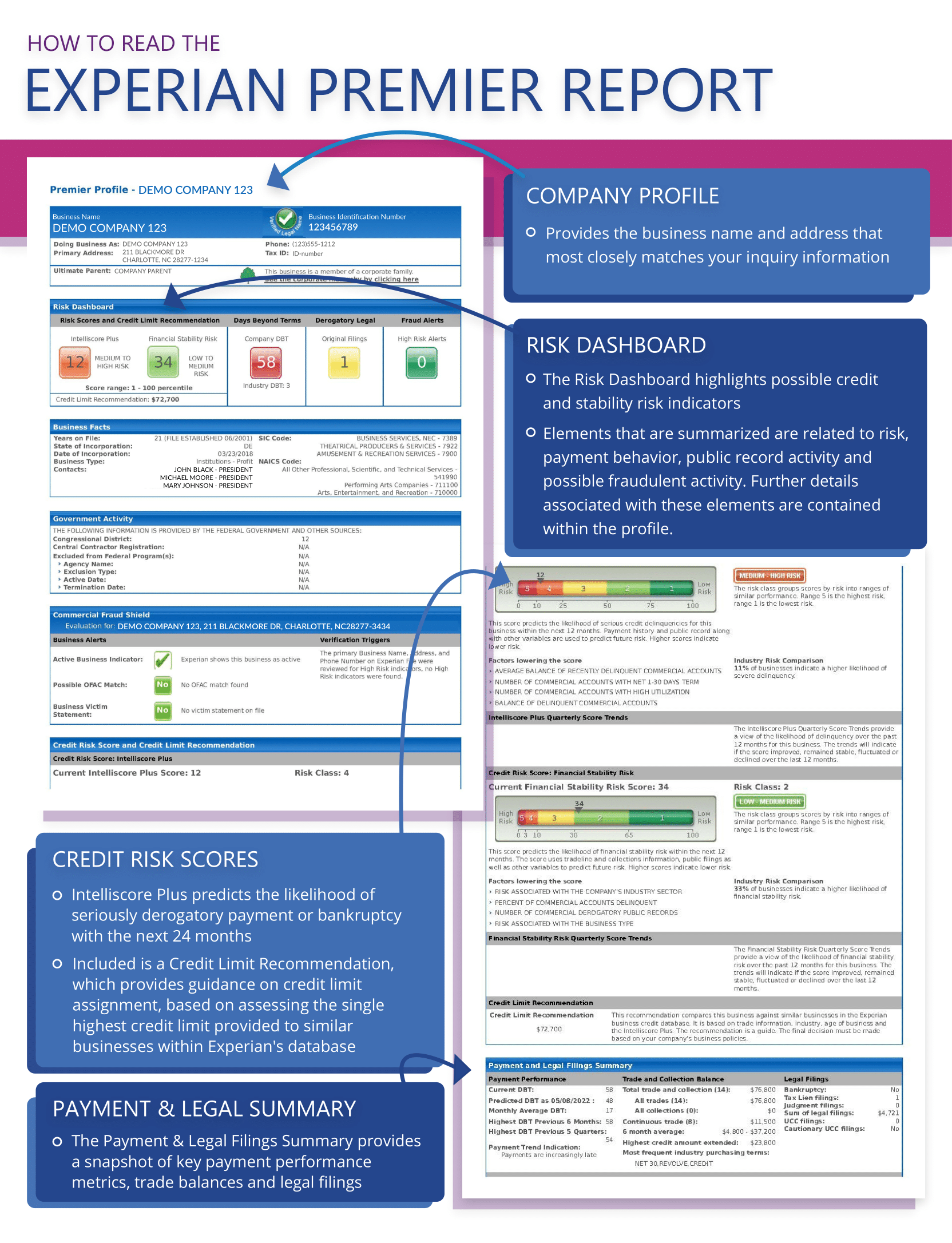

EXPERIAN PREMIER REPORT

DO BUSINESS WITH CONFIDENCE.

WHY CHOOSE THE EXPERIAN CREDIT REPORT?

The Experian Credit Report provides a thorough and clear picture of each new business customer. It highlights each customers strengths and vulnerabilities, along with an in-depth analysis of the business’s financial activities. The report delivers a superior level of customer information, which will allow you to do business with confidence.

REPORT HIGHLIGHTS

-

Risk Scores

The Risk scores depict elements related to risk, payment behavior, public record activity and possible fraudulent activity. Included are the Intelliscore Plus V3, Intelliscore Plus V3 risk assessment, Financial Stability Risk Score V2, and more. -

Credit Limit Recommendations

The Credit Limit Recommendation assesses the single highest credit limit provided to similar businesses within Experian’s database based on Intelliscore Plus score, age, industry and recent high credit to provide guidance on credit limit assignment. -

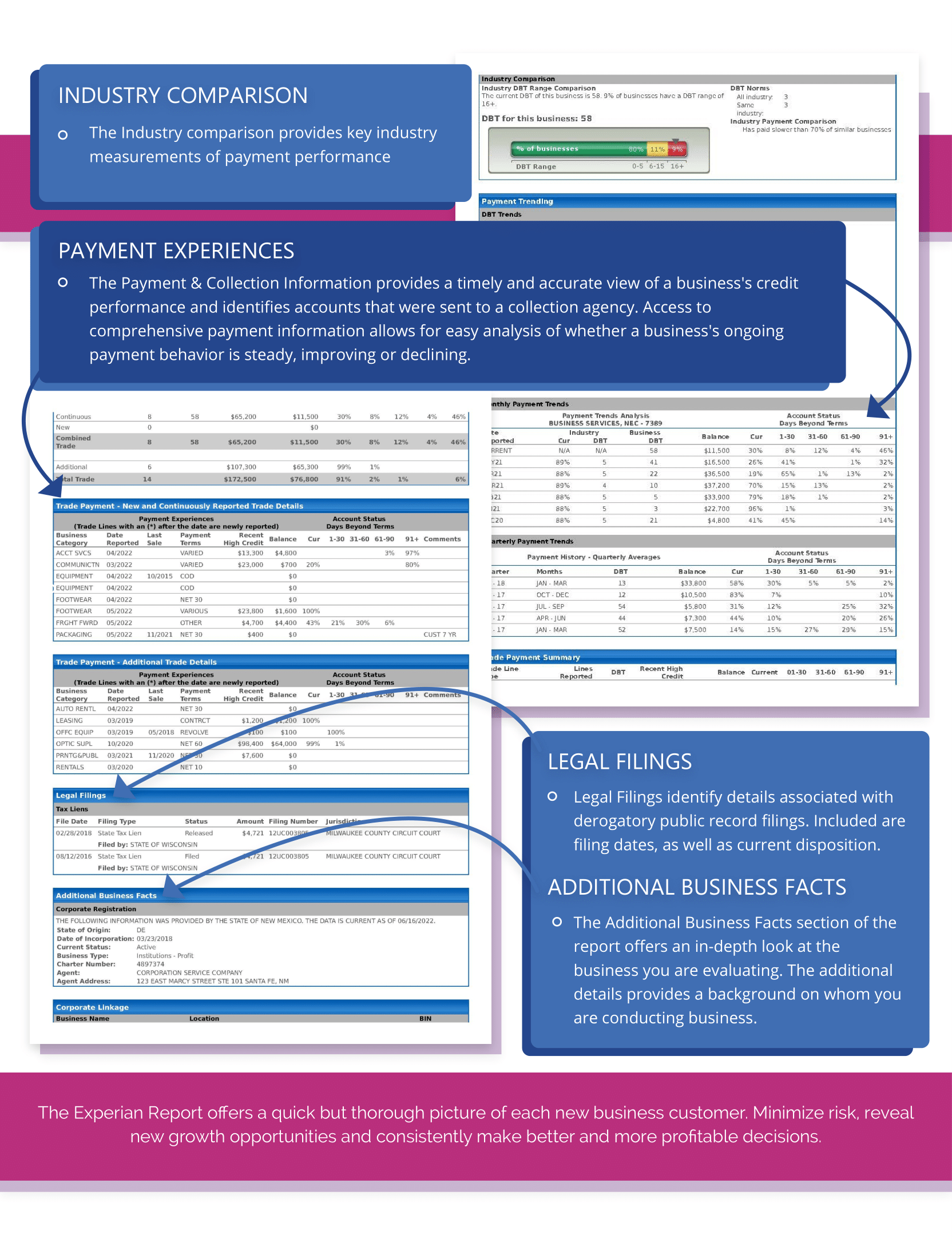

Payment Experiences

Trade Payment and Collection information provides an accurate view of a business’s credit performance, while also identifying accounts that have been sent to a collection agency. Trade payment information may be used to depict how a business pays firms like yours. The information included will help to determine and assess both the company’s ability and willingness to pay.